The financial crisis of 2008 or Global Financial Crisis was a severe worldwide economic crisis that occurred in the early 21st century. The global financial crisis of 200809 that started in the US was caused by excessive lending by banks especially housing loans.

Explaining Malaysia S Deflation Since The 2009 Crisis Asean Today

Portfolio investments saw huge outflows and the stock market which.

. Malaysia like most Southeast Asian. Ajba Download Download PDF. During the Asian Financial Crisis of 1997 and the Global Financial Crisis of 2008 Malaysia suffered a great deal.

Malaysias economic contraction quickened again in the fourth quarter as a fresh virus wave late in 2020 helped drive the economy to. LITERATURE REVIEW Financial crisis can be identified as the condition where demand of money increase. THE MALAYSIAN FINANCIAL CRISIS.

Financial sector after the Asian financial crisis to be more resilient and hence were able to avoid a financial meltdown. Commodity prices in the second half of 2008 saw Malaysias GDP moderate to 01 in the final quarter of 2008. With consumers and investors preferring to keep money reserves instead less money is spent decreasing demand even further.

In the first crisis Malaysias economy collapsed resulting in a. Deflation usually occurs in times of economic crisis and causes stock and purchase inventories to stall. Economic and financial crisis on Malaysia has been felt largely through a contraction in aggregate demand caused by a collapse in exports either directly or indirectly to the United States.

The study assesses the impact of the 2007 US sub-prime crisis on the Malaysian stock market by analysing both the benchmark and sectoral indices. Extreme Volatility in Malaysian Ringgit has roots in the 2008 Financial Crisis. Beginning with bankruptcy of Lehman Brothers at midnight Monday September 15 2008 the financial crisis entered an acute phase marked by failures of prominent American and European banks and efforts by the American and European governments to rescue distressed financial institutions in the United States by.

Bursa Malaysia plummeted on Friday the 13th its steepest drop since the subprime mortgage crisis in 2008 amid cautious sentiment among investors. The global financial crisis of 2008-2009 with its epicentre in the United States has. The crisis led to the Great Recession where housing prices dropped more than the price plunge during.

Department of the Treasury. The quality of. Bundled together the losses led many financial.

Causes Costs and Whether It Could Happen Again. The 2008 financial crisis was the worst economic disaster since the Great Depression of 1929. The domestic economy experienced the full impact.

Reckless lending led to unprecedented numbers of loans in default. Libya Iraq Nigeria Sudan and Syria. ECONOMIC IMPACT AND RECOVERY PROSPECTS MOHAMED ARIFF SYARISA YANTI ABUBAKAR I.

Services to the Rescue in Malaysia. It was the most serious financial crisis since the Great Depression 1929. Our analysis of the impact of the recent global financial crisis on Malaysia therefore begins with an understanding of the Asian financial crisis of 19979 and how it shaped this crisis.

Extremist groups such as ISIS Al Qaeda and Boko Haram thrive in unstable environments such as this. It was politically and. Developing global financial crisis.

Against this backdrop this paper tries to quantify how much deeper the. Malaysia economic monitor. During the AFC of 1997 and the GFC of 2008 Malaysia was one of the countries that were affected.

The Global Financial Crisis of 2008-2009 is widely referred to as The Great Recession. The deficit reached 67 per cent during the 2008-2009 global financial crisis. Predatory lending targeting low-income homebuyers excessive risk-taking by global financial institutions and the bursting of the United States housing bubble culminated in.

2289-4519 Page 151 2. Malaysias economy has been battered since a budget projection was first made late last year with the country beset. 1 It occurred despite the efforts of the Federal Reserve and the US.

Malaysia was hit hard by the global financial crisis of 2008-09. The collapse of oil destabilized many developing nations dependent on stable oil prices. Following the first crisis the Malaysian economy crashed to 7 which resulted.

Back to mind the innovative package of policy measures that Malaysia embarked upon in the dark days of the financial crisis of 1997-2000. Since 2009 Malaysia has seen solid recovery from the global financial crisis that sent it catapulting into deflation. Throughout the period of the global financial crisis underpinned by a strong financial sector and negligible exposure to subprime-related assets and affected counterparties.

REVISITING HOW MALAYSIA OVERCAME THE FINANCIAL CRISIS. Losers thumped gainers by a huge margin with 986 counters down while 158 finished the day higher. Helped soften the impact of the global financial crisis of 200809.

Anticipating the downturn that would follow the episode of extreme financial turbulence Bank Negara Malaysia BNM let the exchange rate depreciate as capital flowed out and preemptively cut the policy rate by 150 basis points. Like other Asian countries Malaysia suffered capital flight. The then Prime Minster Tun Mahathir Mohamed took the bold political decisions to introduce and enforce the measures.

ASEAN Economic Community 2015- Enhancing competitiveness. Exports fell 45 to RM38 billion in January 2009 from RM64 billion in July 2008. Full PDF Package Download Full PDF Package.

Specifically the findings suggest that without the countercyclical and discretionary interest rate cuts and exchange rate flexibility the global financial crisis would have been associated with a much deeper economic contraction in Malaysia. Besides during the economic crisis in 2008 the bank system has a sufficient capital to recovery from the crisis and Malaysian authorities had limited exposure to foreign bank borrowing. The 2008-09 Global Financial Crisis The 2008-09 Global Financial Crisis.

Turnover stood at 567 million shares valued at RM49bil. It began with the housing market bubble created by an overwhelming load of mortgage-backed securities that bundled high-risk loans. INTRODUCTION RIOR to the crisis Malaysia had been dubbed as one of the miracle economies in East Asia owing to its maintenance of high growth rates averaging 89 per cent during the period 198896 in addition to low inflation rate.

GDP growth slowed down to 01 in the last quarter of 2008 and. To investigate the impact pre and post on the global financial crisis 2008 Malaysias banking sector on Deposit Lending Ratio. Malaysia has learned from the Asean financial crisis in 19971998 and much stronger position when entered the global financial crisis in 2008.

Pin On Financial Globalisation And Globalisation And The Environment

Here S How Much Private Debt Countries Have Racked Up Since The Financial Crisis Debt Graphing Private

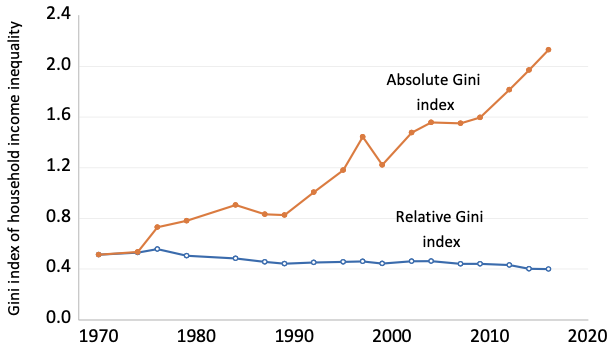

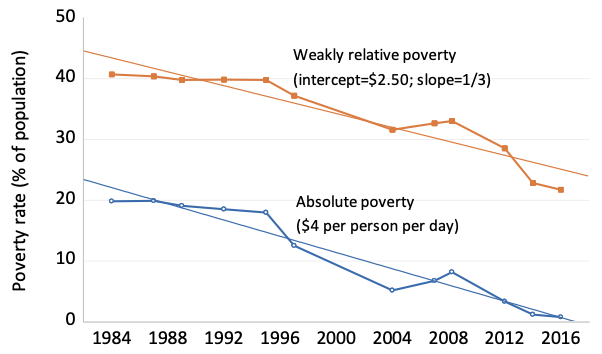

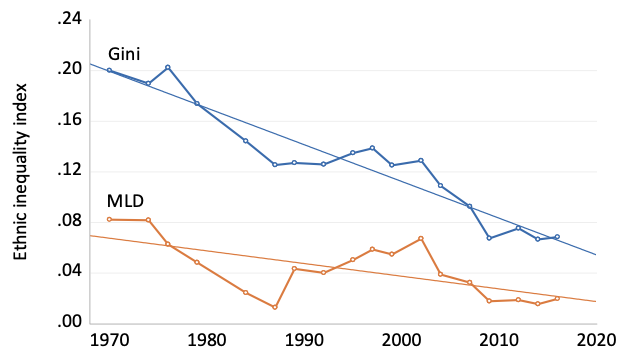

Ethnic Inequality And Poverty In Malaysia Since May 1969 Vox Cepr Policy Portal

Majority In Us Now Optimistic About Job Market Marketing Jobs Job Sayings

Financial Management Solutions Fortune My Financial Management Portfolio Management Financial Advice

Asian Financial Crisis Of 1997

Malaysia S Journey To Become The Next Asian Superpower World Finance

Ethnic Inequality And Poverty In Malaysia Since May 1969 Vox Cepr Policy Portal

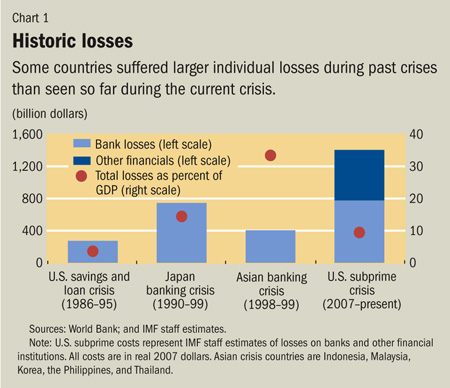

Finance Development December 2008 The Crisis Through The Lens Of History

Malaysia S Journey To Become The Next Asian Superpower World Finance

Pin By Nur Rehan On Cwa Cimb Wealth Advisors Savings Plan How To Plan Stock Market

2022 53 Uncertainties In Malaysia S Economic Recovery By Cassey Lee Iseas Yusof Ishak Institute

Malaysia S Journey To Become The Next Asian Superpower World Finance

2022 53 Uncertainties In Malaysia S Economic Recovery By Cassey Lee Iseas Yusof Ishak Institute

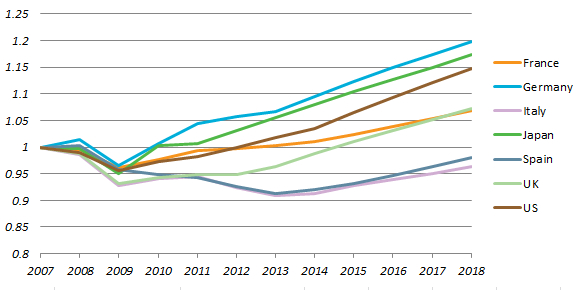

The Recovery From The Global Financial Crisis Of 2008 Missing In Action Euromonitor Com

Ethnic Inequality And Poverty In Malaysia Since May 1969 Vox Cepr Policy Portal

What We Have Seen And Learned 20 Years After The Asian Financial Crisis Imf Blog

2022 53 Uncertainties In Malaysia S Economic Recovery By Cassey Lee Iseas Yusof Ishak Institute

Asia And The Global Financial Crisis Federal Reserve Board